Uneven growth and resource seizing in Africa’s migration hubs

by Fabrizio Maronta

A geopolitical and geoeconomic analysis of Africa’s main migration hubs shows that the continent still faces a challenging outlook. Phenomena of resource seizing (both water and land) affect public services, agriculture and development. Remittances remain a key economic nexus between countries of origin and destination of migration.

Africa’s challenging economic outlook

Future trends in demography and climate need to be considered in the broader African geoeconomic outlook, to have a proper understanding of future trends in the main countries of origin of migration.

The fall in commodity prices throughout 2016 has tested the “Africa rising” narrative. Africa’s growth slowed to 2.2% in 2016, down from 3.4% in 2015. This fall underscores the importance of a few big economies for Africa’s overall growth. Nigeria carries the largest weight, accounting for 29.3% of Africa’s GDP, followed by South Africa with 19.1%. The recession experienced in those two countries therefore had a bigger impact on Africa’s GDP than the recessions elsewhere. In particular, Nigeria’s economic woes increased migration pressure, the country being one of Africa’s big demographic hubs.

While the slowdown has concentrated mainly in commodity exporters, several other factors played a role, including continued effects from the “Arab Spring” and adverse climate factors (bad weather and drought). Continued slow growth in China is taking its toll on Africa: China is now a major trade partner in several African countries, accounting for 27% of Africa’s exports and 83% of its commodities exports.

Regional differences are stark. East Africa leads in terms of economic growth, with an estimated 5.3% in 2016. North Africa comes second at 3%, buoyed by recovery in Egypt and Algeria, while persistent political uncertainties and reduced oil production in Libya continue to weigh heavily on the region. Southern Africa recorded the third-best performance, with growth of 1.1%, while Central and West Africa saw the worst performance: 0.8% and 0.4% respectively. Central Africa was affected by the poor performance of Equatorial Guinea, D.R. of Congo and Chad. West Africa, on the other hand, was dragged down by Nigeria, which experienced a contraction of -1.5% in 2016 from 2.8% growth in 2015.

Poverty and fragility throughout Africa

In this uneven and challenging context, high unemployment remains a problem, particularly in middle-income African countries, reaching up to 50% in some of them. While low-income countries report very low rates of unemployment, the statistics are misleading, masking high levels of underemployment, particularly large informal sectors with low wages and high uncertainty. The informal sector accounts for up to 80% of Africa’s labour force.

Crucially, Africa’s impressive economic growth over the last 15 years has not generated much employment, as it has been concentrated in capital-intensive areas, like the extractive sector, or primary products which do not require much labour. With rapid population growth, this represents a major problem: without diversified, productivity-driven and broad-based growth, Africa will continue to create fewer jobs than needed, given its demographic trends.

No wonder then, lack of jobs affects primarily young people. Despite their improved education, young Africans still suffer from both poor health and a lack of employable skills, as well as limited access to financial assets to start their own businesses. As a result, they suffer disproportionately from high unemployment.

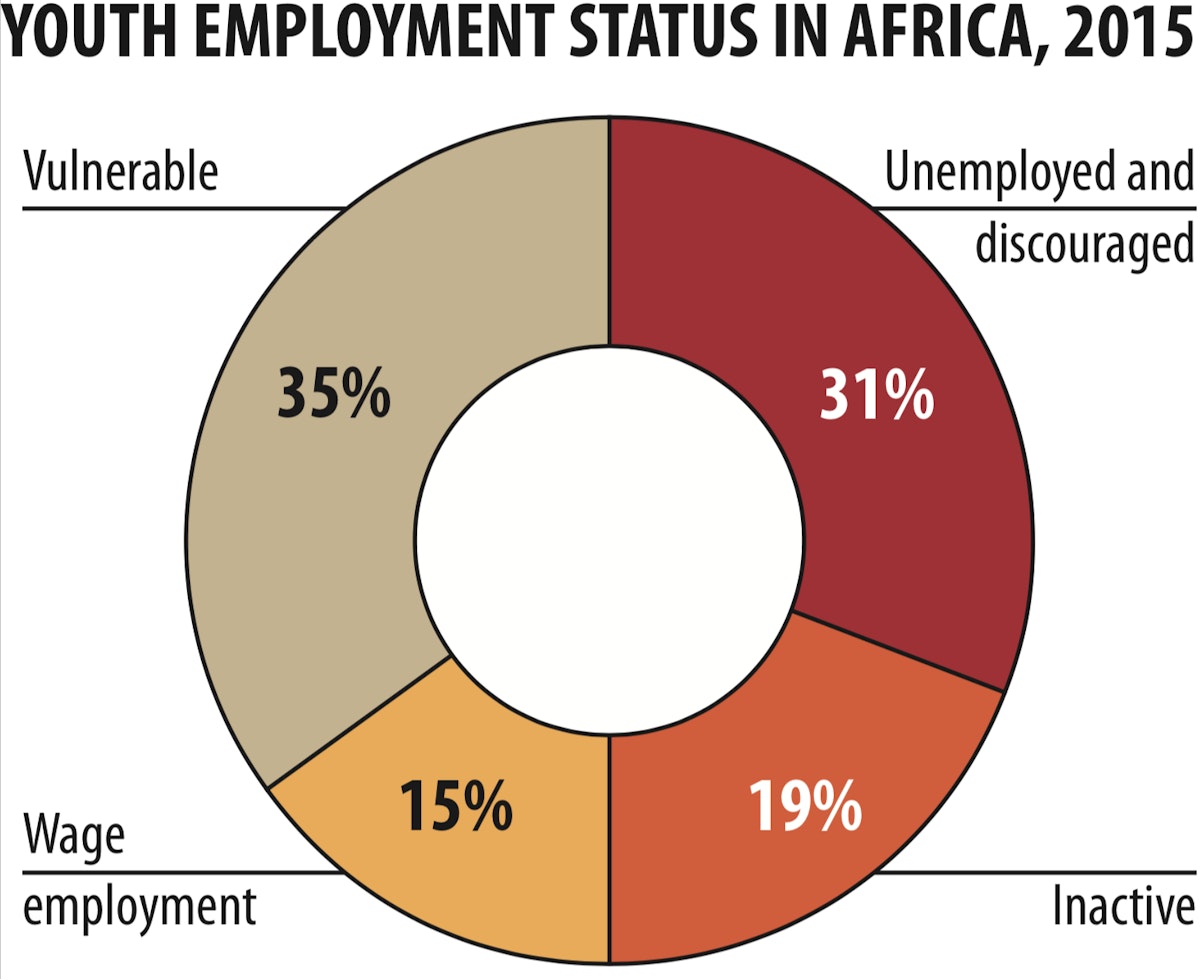

Given current demographic trends, the youth employment challenge will only become more critical. Across Africa, youth are three times more likely to be unemployed than adults. Half of all youth are either unemployed or inactive, while 35% are in vulnerable jobs. Gender inequality makes it worse for women.

This situation contributes to Africa’s income inequality, one of the highest in the world. The average Gini coefficient is 0.43, compared to 0.39 for other developing regions. This is of major concern because high inequality lowers the poverty-reducing power of growth, since the benefits accrue to a smaller proportion of the population. At present, half of Africa’s income goes to just 10% of the population. In 2010, 6 of the world’s 10 fastest growing economies were in Africa. Yet in 2011, 6 of the 10 most unequal countries were also in Africa.

Poverty and inequality often combine with natural fragility and political instability in creating a strong push for emigration. The number of Africans affected by conflict is high. Africa accounts for 11 of the 20 countries with the highest likelihood of conflict. In 2015, out of the 65.3 million people forced to flee their homes because of violence and persecution, 37% lived in the Middle East and North Africa, and a further 27% were south of the Sahara. In Africa, the most affected countries were Sudan (3.5 million people displaced), Nigeria (2.2 million), South Sudan (2.1 million) and the DRC (1.9 million).

Africa also saw an increase in numbers affected by natural hazards, particularly drought and flooding – 7.6 million in 2014. That figure rose to 23.5 million in 2015, almost half of which (more than 10 million) were in Ethiopia.1

The geopolitics of water

In the context of environmental fragilities caused by climate change and its related phenomena, one of the key issues linked to food availability in Africa (as elsewhere) is of course, water. In fact, among the many challenges the continent faces a major one is the ability for Africans to access clean and adequate water supplies, both for human consumption and irrigation/livestock feeding. Both aspects are relevant but the latter is crucial in the context of this report.

It is worth remembering a well-known, but often overlooked fact – that agricultural and livestock production combined consume more fresh water than any other activity. According to FAO Aquastat (2017), agriculture accounts on a global average for 70 % of total water withdrawals. The water needed to produce crops and livestock also varies significantly, ranging from 197 litres /kg of sugar crops to 15415 litres /kg of bovine meat (Water footprint network 2017).

Livestock directly uses only 1.3% of the total water used in agriculture. However, when the water required for forage and grain production is included, water requirements for livestock production dramatically increase (WWF 2014).

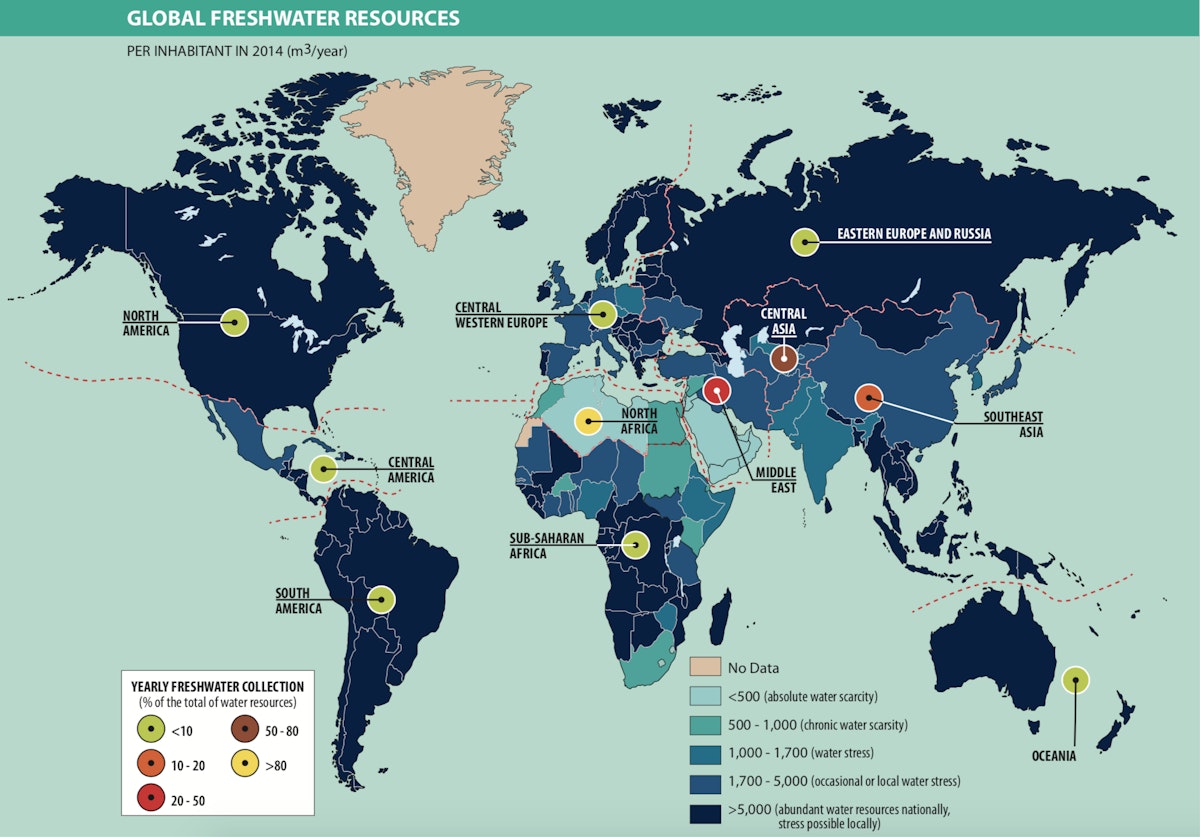

Overall, Africa has about 9% of the world’s fresh water and 11% of the population, but there is significant unevenness in terms of water availability (GRAIN 2012). Moreover, infrastructure is still poor, even in key economic sectors like agriculture, on which most Africans depend. African agriculture remains mostly based on rainfed farming, and well below 10% of cultivated land is irrigated (GRAIN 2012; Lewis 2013).

The region most affected by water-related challenges in Africa is Sub-Saharan Africa. According to the WHO, in 2006 only 16% of people in the area had access to water through a household tap (WHO 2008), and the situation does not look much better today (WHO 2015). Even when water was available, there were risks of contamination due to several factors: among them, poor maintenance of wells and water sanitation facilities (when they exist) due to limited financial resources and lack of proper water quality testing. Once water is provided, its quantity is often given more attention than its quality.

By 2030, 75 to 250 million Africans (mostly in the Sub-Saharan region) may be living in areas of high water stress, and this would likely displace anywhere between 24 million and 700 million people. Surface water sources are often highly polluted, and infrastructure to pipe water from fresh, clean sources to arid areas is expensive (GRAIN 2012; WHO 2015).

Groundwater, although not immune from overexploitation and pollution, has a somewhat better outlook. In fact, it is naturally protected from contamination (unless heavy metals or bacteria coming from leaking sewage infect it) and its availability is less affected by droughts, at least in the short term.

However, limits to tapping induced by the high costs of drilling represent an obstacle. This leads international institutions dealing with the issue to distinguish between “physical” and “economic” water scarcity: the first being the absolute lack of water, the second referring to its inaccessibility due to the financial and technological challenges posed by the effort.

The lack of clean water (and consequent access to adequate sanitation) has widespread implications. Young children die from dehydration (because of diarrheal illnesses) and malnutrition. Diseases such as cholera are rampant during the wet season. Women and young girls, who play a key role in carrying water, are prevented from doing income-generating work or attending school. They are also at risk of violence since they travel such great distances from their villages on a daily basis.

In urban areas meanwhile, especially in Sub-Saharan Africa, the rapid growth of cities has led to large volumes of water being extracted from existing sources, resulting in their depletion. Moreover, the development of wastewater management systems has not kept pace, leading to pollution of natural water bodies and crops irrigated with them, irregular water supply, and threats to aquatic life.

Land acquisitions and water seizing

No less important to Africa’s water issue are external factors, namely the land and water acquisition activities (two sides of the same coin) carried out by foreign actors for farming/agricultural ends or as a form of commodity speculation. Here we refer mainly, though not exclusively, to the forms of land acquisition termed by the Tirana Declaration as “international”, i.e. “large-scale land grabbing […] which we define as acquisitions or concessions that are one or more of the following: (i) in violation of human rights, particularly the equal rights of women; (ii) not based on free, prior and informed consent of the affected land-users; (iii) not based on a thorough assessment, or are in disregard of social, economic and environmental impacts, including the way they are gendered; (iv) not based on transparent contracts that specify clear and binding commitments about activities, employment and benefits sharing, and; (v) not based on effective democratic planning, independent oversight and meaningful participation.” (International Land Coalition 2011).

In recent years, foreign companies from the Gulf, India, China and elsewhere — including Europe – have been acquiring millions of hectares of lands in Africa. A country like Saudi Arabia does not lack land for food production. What’s missing is water. The same can be said for the Indian sub-continent – depleted by decades of unsustainable irrigation – or for China, where water scarcity, soil erosion and pollution affect food production and water availability.

Thus, when looking at land acquisition in Africa – or in Latin America, for that matter – one has to consider that the value is not so much (or only) in the land as it is in the water it hosts. All of the land deals in Africa involve large-scale, industrial agriculture operations which consume massive amounts of water. Nearly all of them are located in major river basins with access to irrigation, in fertile and fragile wetlands, or in more arid areas that can draw water from major rivers. In some cases, the farms directly access ground water through pumping systems.

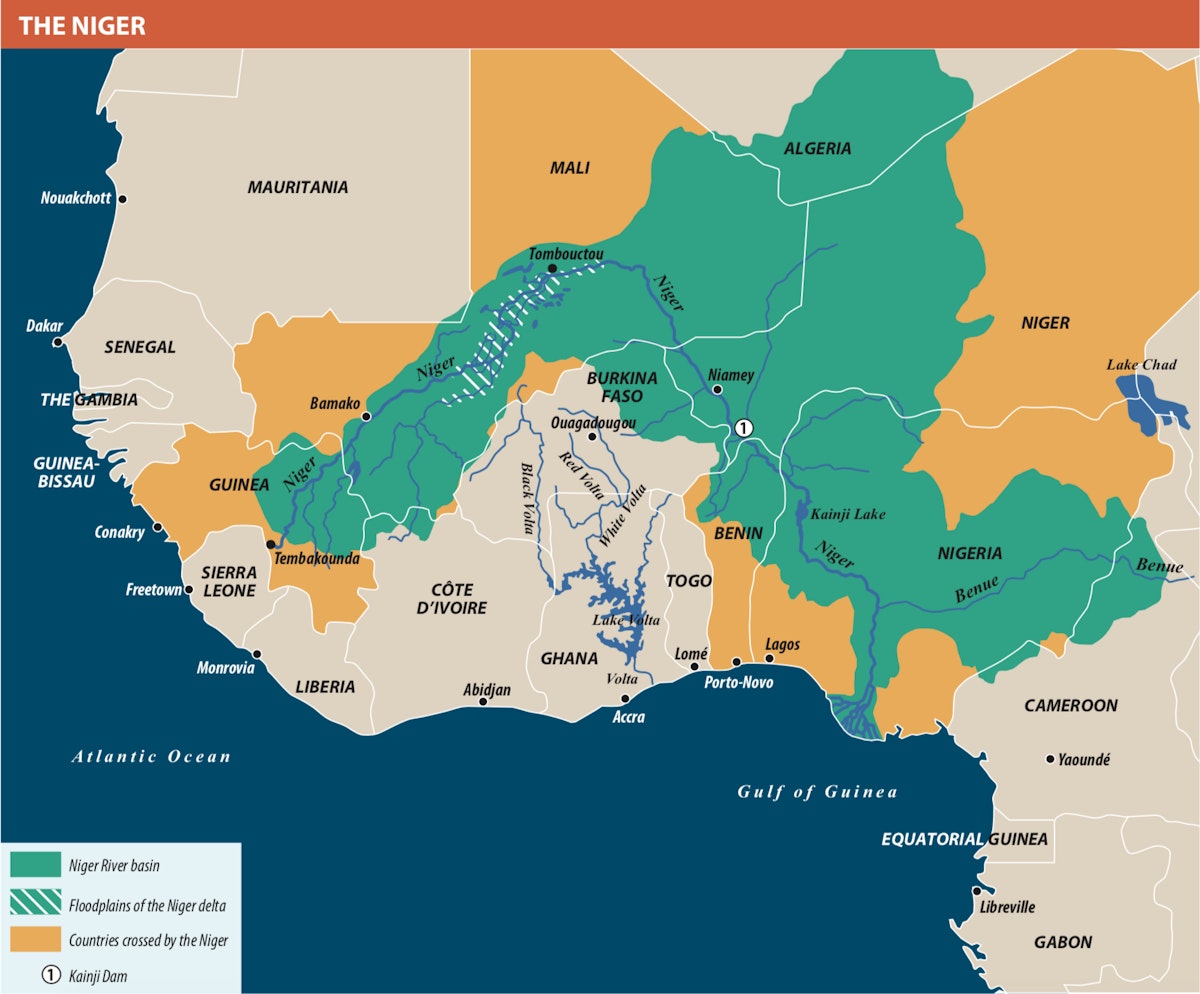

Two examples which illustrate this perverse dynamic are the Niger and Nile rivers.

The former is West Africa’s largest river and the third longest on the continent. Millions rely on its basin for agriculture, fishing, trade and as a primary water source for hydropower provision by public infrastructures. Mali, Niger and Nigeria are the most dependent on the river, but several other countries share its waters. The river has suffered under the strain of dams, irrigation and pollution. Water experts estimate that its volume has shrunk by one third during the last three decades. Others warn it might lose another third due to climate change, in particular due to increased variability of inflow that will make reliability of inter-annual water availability more uncertain and fluctuating, affecting large scale irrigation projects in terms of effective irrigable surface.

In Mali, the river spreads out into a vast inland delta, which constitutes Mali’s main agricultural zone and one of the region’s most important wetlands. Here the Office du Niger presides over the irrigation of tens of thousands of hectares, mainly for rice production, using a substantial part of the Niger’s water, especially during the dry season. In the 1990s, FAO estimated Mali’s potential to irrigate from the Niger at slightly over 500,000 hectares. Now, due to increased water scarcity, independent experts put that capacity at just 250,000 hectares. Yet the Malian government has signed away over half a million hectares to foreign companies from North Africa, China, the UK and Saudi Arabia (among others). Independent studies calculate that over 70% of the floodplains of the inner Niger delta could be lost, with a dramatic impact on Mali’s ability to feed its people (GRAIN 2007).

Africa’s longest river, the Nile, is a lifeline for Egypt, Ethiopia, South Sudan, Sudan and Uganda and is a source of significant geopolitical tensions since 1959, when a colonial deal brokered by Great Britain allocated three quarters of the average annual flow to Egypt and just a quarter to Sudan. Massive irrigation schemes were built in both countries to grow cotton for export. In the 1960s, Egypt built the enormous Aswan dam, which stopped the flow of nutrients and minerals which fertilized the soil downstream. In Sudan, the Gulf States financed a further increase of irrigation infrastructure in the 1960-70s in an effort to turn Sudan into the breadbasket of the Arab world. This was unsuccessful and half of Sudan’s irrigation infrastructure currently lies abandoned or underused. In the past few years the conflict over the Nile water has received significant attention after the decision by Ethiopia to build a large dam (the Grand Ethiopian Renaissance Dam) to produce electricity to be also exported to neighbouring countries. The dam, currently under construction, raised serious concerns regarding its effect on water shares of downstream countries (e.g. Egypt and Sudan).

Both Sudan and Egypt produce most of their food from irrigated agriculture, but both face serious problems with soil degradation, salinization, waterlogging and pollution induced by the irrigation schemes. As a result, the Nile barely delivers water to the Mediterranean any longer, undermining agricultural production in its once fertile delta.

In recent years, this fragile basin has been the target of a new wave of large-scale agriculture projects. Ethiopia, South Sudan and Sudan have leased out millions of hectares in need of irrigation. Ethiopia is the source of some 80% of the Nile’s water. In its Gambela region (bordering South Sudan), Indian and Saudi corporations are building large irrigation channels that will increase Ethiopia’s withdrawal of water from the Nile enormously. In South Sudan and Sudan, an area greater in size than the Netherlands has been leased out to foreign corporations. To the north, Egypt is also leasing out land and implementing its own new irrigation projects. It is difficult to imagine how the Nile can handle this.

As previously mentioned, Europe is not foreign to land acquisition. On the contrary, it is well into it. If the major current international investors are the Gulf States and China, EU States have increased demand for land acquisition. In particular, six European countries are among the biggest investors in terms of outwards Foreign Direct Investment stock in agriculture: Italy, Norway, Germany, Denmark, the United Kingdom, and France (FIAN 2011, for further explanation see also Antonelli et al. 2015).

European involvement in land acquisitions is first due to the activity of both the EU and individual member States, whose policies directly and indirectly stimulate economic sectors that increase demand for land. The main of those is by far agrofuels. A relatively recent case in point is Italian ENI, which in 2009 undertook a multi-billion dollar land acquisition project in the Republic of the Congo to develop, amongst other things, oil palm for biodiesel (Oil Watch Africa 2009).

EU Directive 2009/28EC (April 2009) has set a mandatory target for member States: a minimum 10% share of renewable energies (including agrofuels) by 2020. Under this directive, each State has been obligated to adopt a national renewable energy action plan establishing national targets for renewable energy consumed in transport, electricity, heating and cooling. Since production costs are not in line with those of fossil fuels, the EU market for agrofuels depends largely on incentives. Several media outlets and NGOs have highlighted the relationship between the EU directives, State policies and the increasing land acquisitions by European companies for agrofuels production. (GRAIN 2007).

In this frame, European development cooperation is actively supporting the introduction of agrofuel policies in African countries, such as Mozambique and others (Ecoenergy 2008), while European banks are also involved in promoting agrofuel production in Africa, in the form of financial support to private (and in some cases, public-private) endeavours 2.

Another factor to be taken into account is the effect of the financial crisis, since recently the finance sector has been turning towards land as a source of solid returns. From 2008 on, an army of investment houses, private equity and hedge funds – many of them European – have been acquiring farmlands throughout the world and especially in Africa (GRAIN 2008), in countries like Mozambique, South Africa, Botswana, Zambia, Angola, Swaziland and the D.R. of Congo.

NOTES

1 See UNDP (2015).

2 “Aktion: Kein Zuckerrohr für deutsche Autos!”, Rettet den Regenwald, 15/4/2015.